When an issuer faces a liquidity issue, it can hamper the bondholder’s interest or principal repayment schedule. It also affects the issuer’s financial stability, directly impacting bondholders. Increment and decrement in the bond’s interest rate depend on the bond price, as the bond’s price is inversely proportional to the interest rate. This fluctuation or change in bond price impacts the institutional and mutual funds investors with exposure to bonds.

3 High-Yield Bond Funds to Buy for Great Returns – 24/7 Wall St.

3 High-Yield Bond Funds to Buy for Great Returns.

Posted: Wed, 09 Aug 2023 10:55:11 GMT [source]

In most ways investing in bonds benefits everyone because of the dependability of interest and principal returns. That’s usually the minimum to buy a bond, though you can buy a diversified bond portfolio for much less using bond ETFs. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Investors considering fixed-income securities might want to research corporate bonds, which some have described as the last safe investment. As the yields of many fixed-income securities declined after the financial crisis, the interest rates paid by corporate bonds made them more appealing. Mainly two types of returns are available on two types of bonds in the bond market, i.e., fixed-rate bonds and floating-rate bonds. In fixed-rate bonds, the returns are fixed (pay a predetermined interest rate at regular intervals); in floating-rate bonds, returns fluctuate (fluctuation based on benchmark rate). The customer price index and London interbank offer rate are considered benchmark rates.

What advantages and disadvantages do bonds offer investors relative to stocks? What type of…

For example, security of principal and income are strong across corporate bonds and municipal bonds but less so for stocks and bond funds. We first discuss corporate bonds advantages vs. bond funds, municipal bonds, and stocks. Not all of the disadvantages apply to the other asset classes, which is why we discuss corporate bonds advantages and disadvantages separately. Bond ratings offer several advantages, such as being easy to understand and apply due to their concise summary of the creditworthiness and default risk of bond issuers and their debt securities. Additionally, rating agencies review and revise their ratings regularly to reflect changes in the credit quality and risk profile of bond issuers and their debt securities, as well as market conditions and events.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, advantages and disadvantages of bonds needs, risk tolerance and investment objectives. Joint Bonds are issued jointly by two or more entities who share liability for the debt, while individual bonds are issued by a single entity who is solely responsible for the debt. Joint tenancy bonds offer a more balanced risk-sharing arrangement among the issuers, but they may provide less protection for bondholders compared to joint and several bonds.

What are the advantages of a bond?

Mail us on h[email protected], to get more information about given services.

- Furthermore, each asset class features dramatically different structures, payouts, returns, and risks.

- Corporate bond investing has come a long way from the 1970s and 1980s, when most bond trades were done over the phone, and investors had little idea on whether they were getting a fair price.

- Most of these securities come with a call provision, meaning that investors receive the initial interest rate until the call date.

- In Figure 1, we compare individual corporate bonds vs. bond funds, municipal bonds, and stocks.

A debt fund or a bond fund is a pool of investments, usually a mutual fund or an exchange-traded fund, that invests in fixed-income securities. The fixed-income securities include government bonds, corporate bonds, money market instruments, junk bonds, etc. Bond funds do not have underlying financial metrics, such as revenue and cash flow growth, leverage ratios and interest coverage ratios, where investors can evaluate the financial wherewithal of the issuing company. It is, therefore, impossible to assess the relative value of a fund like you can with a corporate bond or stock. With individual corporate bonds, investors can compare the foregoing financial metrics to how a bond is priced and evaluate a bond’s relative value.

Key Corporate Bonds Advantages and Disadvantages

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Bankrate follows a strict

editorial policy, so you can trust that our content is honest and accurate.

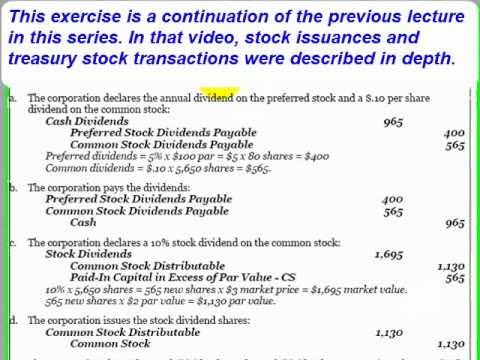

It is difficult to anticipate the NAV of the fund, and it makes bond funds less attractive to investors compared to individual bonds. In general, stocks are riskier than bonds, simply due to the fact that they offer no guaranteed returns to the investor, unlike bonds, which offer fairly reliable returns through coupon payments. Stocks are inherently more volatile than bonds because in the event of a corporate bankruptcy, bondholders (who are a company’s creditors) have priority in being repaid. Meanwhile, owners of common stock are last in line, and can end up with nothing if the company goes bankrupt. Beyond maturity considerations, corporate bonds may offer many different coupon structures.

Help Others, Please Share

In India, the long-term investment return for a bond can be less than for equities. Still, equity investments yield about 12%, and the bond tax is more than equity, indicating that the overall return from a bond is significantly lower than equity. Steve Shaw founded BondSavvy because, through his own investing experience, he benefited from the income, growth, and relative safety individual corporate bonds can provide.

A bond’s coupon is set at a predetermined rate, typically between 0 and 3 percent. Investors may earn a guaranteed income with regular interest–or coupon–payments. Before standard stockholders, bondholders are paid in the event of corporate bankruptcy. The chief advantage stocks have over bonds, is their ability to generate higher returns. Consequently, investors who are willing to take on greater risks in exchange for the potential to benefit from rising stock prices would be better off choosing stocks. One major draw of corporate bonds is their strong returns, compared to other bond, such as government bonds.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Such bonds are rated below investment grade, and are referred to as high-yield bonds, non-investment-grade bonds, speculative-grade bonds, or junk bonds. Nevertheless, they attract a subset of fixed income investors that enjoy the prospect of higher yields. If the issuer goes out of business, the investor may not receive interest payments or get their principal back. This contrasts with bonds that have been issued by a government with a high credit rating, as this entity could theoretically increase taxes to make payments to bondholders. While there are exceptions, a significant portion of the 9,000 individual corporate bonds available for online investing regularly trade throughout the day.

Funds that invest the majority of the money into equity stocks are known as stock funds. Since it’s the money involved, there are certain Disadvantages of investing in bonds the investors or issuers may face at times. It’s mostly the big players like banks, insurance companies, or sovereign wealth funds that buy and trade. This can be done through loans or bank financing but is often accomplished through the sale of bonds.

Multisector bond funds also tend to focus on bonds based on the time horizon. For example, some of the funds may focus on shorter-maturity bonds, thus making the fund less exposed to interest rate changes. In other words, they offer a rate that is equal to LIBOR+ a stated interest margin. The caveat of this type of fund is that securities have a higher default risk than investment-grade securities. However, since the fund invests in a broad range of junk bonds, one of the bonds getting default will not significantly impact your portfolio. If bonds are held to maturity the investor will receive the face value, plus interest.

- In general, the longer your time horizon (i.e., the younger you are), the more risk you can take on.

- Inflation reduces purchasing power, which is a risk for investors receiving a fixed rate of interest.

- That said, if we buy a 5-year bond issued by Wal-Mart or an issuer of similar credit quality, we know exactly the amount of principal we will receive in five years.

This can expose issuers to risks and liabilities that may not be directly related to their core business activities, potentially impacting their financial performance and credit ratings. Many might assume that, given their massive size, bond funds would have greater income security. In a January 12, 2023 article in The Wall Street Journal titled “For Closed-End Fund Investors, Paper Losses Turn Real,” Heather Gillers explains how a PIMCO California municipal bond fund cut dividends by 45%. Please note that Figure 2 uses a different y-axis scale than Figures 3 and 4 to show greater detail for high yield corporate bonds with yields above 7%.

This happened in the wake of Covid-19 in 2020, as many blue-chip companies either stopped paying dividends or significantly reduced them. The portfolio allocation to the different bonds should be noted, as some funds may have more money allocated to high-yield bonds than U.S. Another type of security is a floating-rate loan or leveraged loan that is issued by non-investment grade companies. These loans have a coupon rate that is floating above a common benchmark rate, such as the London Interbank Offered Rate (LIBOR).